The fresh nonbank home loan company states forty-year, interest-just money can assist individuals and you will buyers who had been listed from the current housing market.

Register all of us at the Inman Link Nyc it January to have 75+ instructional courses, 250+ specialist speakers, and you will networking options which have lots and lots of globe gurus. Register now for our Labor Big date unique speed a great owing to September 5! Check out these types of simply announced sound system for this have to-sit-in feel. Sign in right here.

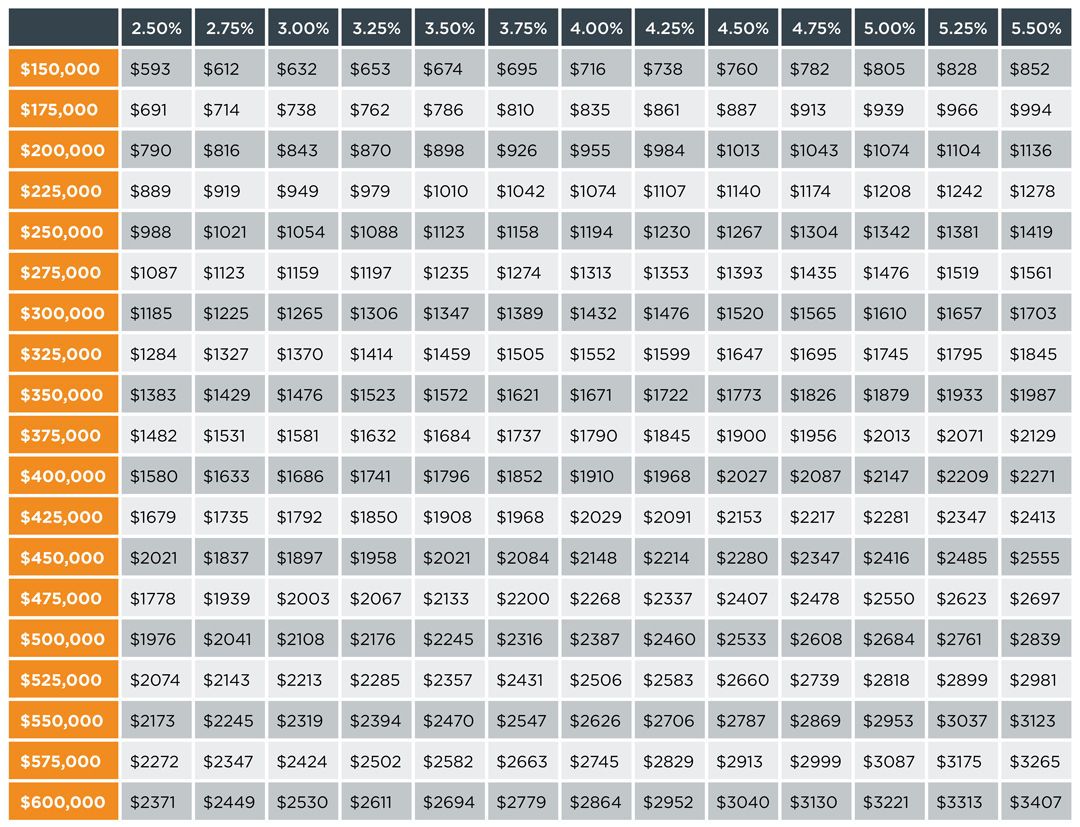

Nonbank lending company Newrez goes returning to this new playbook from the last property growth, moving away good forty-12 months repaired-rate mortgage they claims will assist consumers and you may people who possess been cost from today’s housing marketplace giving less monthly payment.

Instance Newrez’s most other Smart Show mortgage factors, the fresh new forty-season financing are a good non-Accredited Mortgage, otherwise non-QM, definition it’s not entitled to get or make sure by mortgage creatures Federal national mortgage association and you may Freddie Mac computer, thus consumers typically shell out high pricing.

Brand new providing is even an interest-simply financing to the basic 10 years, definition homeowners which make use of it to invest in a purchase will not be required to pay down one mortgage dominant with the very first decade they have their houses.

Our very own Wise Show items, such as the forty-year [interest merely], try built to meet the needs regarding today’s consumers and you will open the entranceway so you can several thousand prospective property owners, told you Newrez Co-Direct of Creation Jeff Gravelle when you look at the a statement.

Newrez claims the fresh 40-Year attention-only choice is present for everybody Smart Series products and is actually now-being ended up selling using all of the organizations credit channels — retail, general, correspondent, jv and you can head-to-user.

But unless homebuyers make more minimal monthly payment, the only method they obtain most security within residential property throughout the the interest-just months is if their residence’s worth goes up. And if the residence’s really worth depreciates, they’re able to easily end up underwater — owing more about their financial than simply their house is really worth.

The new 40-12 months repaired-price mortgage has returned

Newrez’s SmartSelf financing — which it touts as the ideal for notice-working individuals demanding making use of financial statements and you may/or asset amortization to help you be considered — isnt open to basic-date homeowners and requires the very least down payment away from 10 percent for fund of up to $2 million. Borrowers having advanced credit (a credit history out-of 740 otherwise a lot more than) can be acquire to $step three mil whenever getting 20% down.

The minimum credit history for most SmartSelf loans are 660, but the forty-year focus-sole option demands a minimum credit score off 680. Dallas installment loans no bank account A borrower with an effective 680 credit history can be use to $1.5 million with a beneficial 15 % deposit or $2 billion which have a 20 percent advance payment.

Next time available for 40-season funds

During the homes bubble that preceded brand new 2007-09 mortgage crisis and also the High Market meltdown, Federal national mortgage association started to find 40-seasons fixed-rate mortgages immediately following unveiling an effective pilot system for the 2004 with borrowing unions.

Although the suggestion was panned during the time of the experts in addition to The mortgage Teacher Jack Guttentag, Fannie mae lengthened the application in 2006, as well as a short while, lots of big-term lenders including Wells Fargo, Bank regarding The united states and you can Arizona Common provided the newest finance. For a time, there is certainly also speak that fifty-year mortgages could be the best way to help homebuyers deal which have rising home prices.

But when resource for subprime loan providers dry out during the 2007 and the fresh new casing bubble popped, loan providers such as for example Washington Common ran lower than, and Fannie and you can Freddie wound-up for the regulators conservatorship from inside the 2008, since the possible loss regarding the subprime mortgage crisis mounted.

Mortgage loans which have forty- and you may fifty-season terms gone away from the world before you take significant share of the market. It absolutely was subprime fund which have lax underwriting standards and you will exotic have that have been blamed to own a lot of this new runup home based cost from inside the construction ripple.

Today, most lenders are Certified Mortgage loans appointment conditions followed in 2014 in order to discourage lenders of providing high-risk finance and to encourage them to very carefully view for every borrower’s ability to settle.

Loan providers just who meet with the QM criteria is actually granted an appropriate safer harbor out of legal actions from the consumers, which makes it easier in order to bundle finance with the home loan-backed securities which can be marketed to help you investors.

Whenever Uk Best Minister Boris Johnson floated the idea of 50-seasons mortgage loans for the July, Metropolitan Institute other Laurie Goodman said she doubted one mortgage loans with terminology beyond thirty years would take control the new You.S., from the difficulty regarding selling like funds so you’re able to secondary industry investors.

You might go do a good 40-season mortgage, however, no one would buy it, Goodman told Inman during the time. The whole home loan experience influenced by the new 30-seasons home loan markets.

Newrez didn’t instantly address a request for discuss if consumers taking out fully forty-season, interest-only loans could well be within greater risk off default in the experiences regarding good downturn, and you can whether Newrez will be able to securitize new finance.

Come july 1st, non-QM loan providers Spring up Financial and you can First Guarantee Mortgage Corp. was in fact forced to stop and also make loans, apparently while they had issues attempting to sell financing so you’re able to dealers whenever mortgage prices increased in the 1st half of the season.

Newrez’s mother or father providers New Home-based Money Corp., might have been expanding the home mortgage origination team, letting it claim a place among the many country’s ideal five nonbank mortgage lenders.

Last year, Brand new Residential gotten Quality Lenders having $1.675 million. Because year’s spring homebuying seasons banged from, Newrez established a collaboration having local information system Spot to market home loans to people in more than simply step 1,2 hundred organizations along the You.S. New Residential likewise has jv partnerships which have Real estate professionals, homebuilders and mortgage banking institutions along with their subsidiary Shelter Mortgage lender LLC.

Rating Inman’s Most Borrowing from the bank Newsletter lead to their inbox. A weekly roundup of all most significant development international regarding mortgages and you will closings introduced all the Wednesday. Click on this link to subscribe.